The Wall Street Journal (WSJ) published an article, titled “Climate Change Is Coming for the Finer Things in Life,” claiming that by causing “wonky weather,” climate change is disrupting crop production for a variety of crops. This story is false on two counts: First, there is no evidence climate change is causing wonky weather or changing weather trends at all; second, the yields and production of each of the crops discussed in the story have grown dramatically during the recent period of modest warming regularly setting records. If anything, climate change has resulted in more grapes (and wine), olives (and olive oil), coffee, and cocoa.

“As the world warms, extreme weather is disrupting the production of some of life’s great comforts—wine, olive oil, coffee, and cocoa,” Jon Emont writes for the WSJ. “Some of these crops are concentrated in one or two regions, which means wonky weather in one part of the world can have a dizzying impact on global prices.”

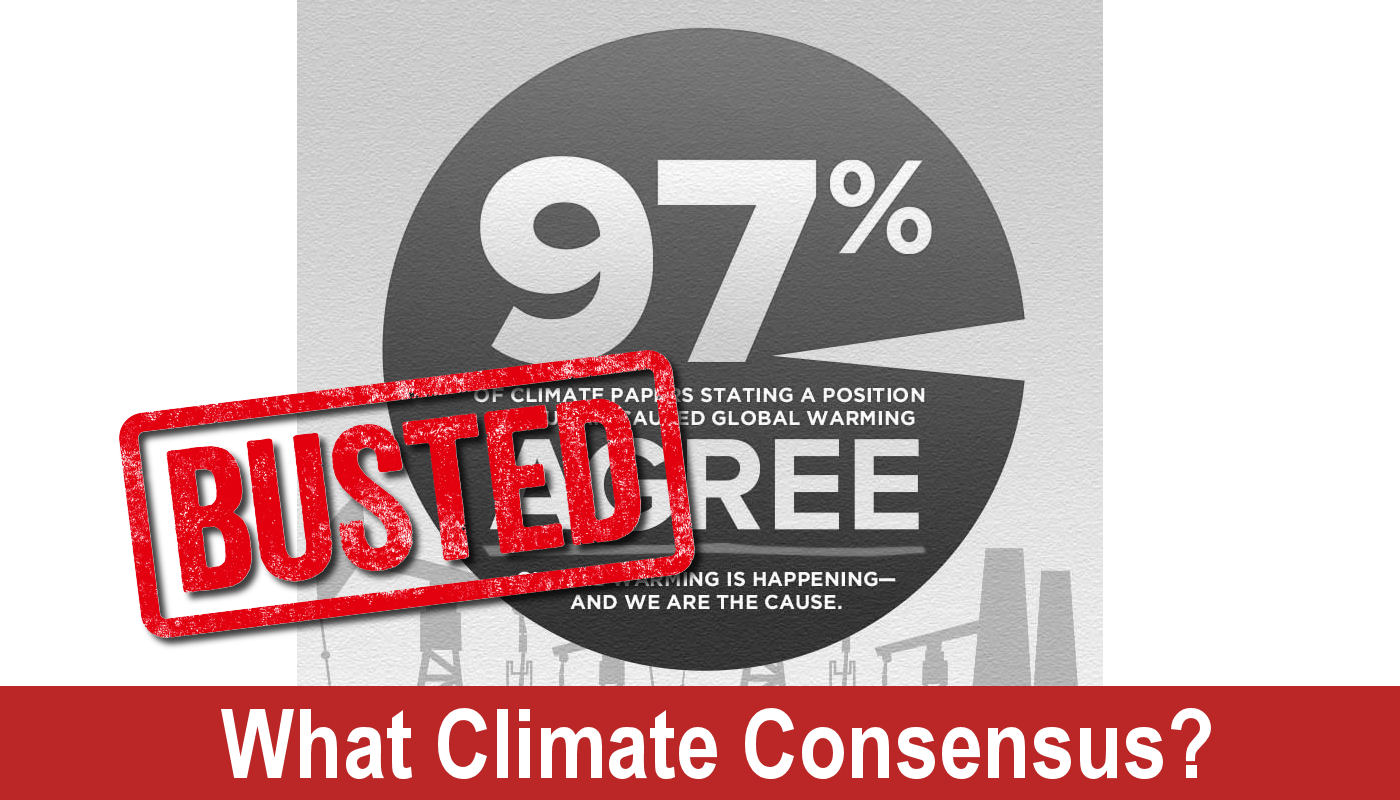

Real-world data presented in Climate at a Glance, show drought, heatwaves, floods, tropical cyclones, and wildfires, or a variety of other extreme weather events or impacts have not become “wonky.” Such events are no more frequent, powerful, or unpredictable than they have been in the past. And, plants and pollinators are doing well. So, except for the normal ups and downs farmers have always experienced historically nothing strange is happening weather wise. Hundreds of post on Climate Realism confirm that weather trends have not worsened and crop growth has increased, including for the crops and the regions discussed by the WSJ, such as Vietnam and West Africa.

Concerning the crops discussed, agricultural production has always been more or less at the mercy of the weather. So olive production and associated olive oil might be down for a year or two, same with grapes and wine, coffee, and cocoa, but to make the case that climate change is causing a decline one must look at long-term trends, One or two year’s weather does not proof of climate change make.

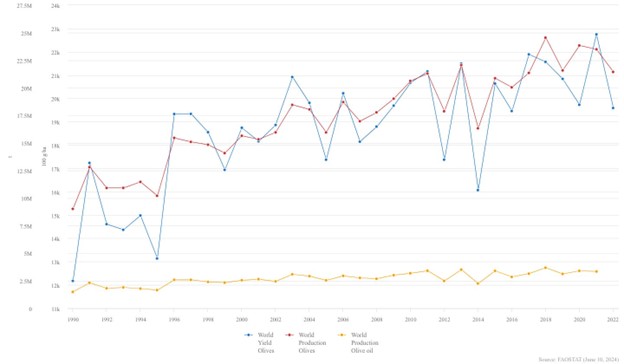

Let’s look at crop data to discern what trends exist, if any, something neither Emont nor WSJ did. The U.N. Food and Agriculture Organization maintains a database of global agricultural production and it shows that each of the crops and products discussed by Emont in his misguided WSJ post have repeatedly set new records for yield and production over the past thirty years of climate change. Between 1990 and 2022, the most recent year for which data is available, FAO data show, that olive production increased approximately 138 percent, and yields increased by about 61 percent. Over the same time period, olives set new production records 11 times, with the most recent record set in 2018, with the second highest production year coming in 2020. Olive yields set records eight times since 1990. Although not all olives are used to make olive oil, olive oil trends are similar. Between 1990 and 2021, the last year of FAO data, olive oil production grew by a little over 124 percent. (See the graphic below)

As dozens of Climate Realism posts have shown before, what’s true of olives is true of grapes, cocoa, and coffee as well.

Concerning cocoa and coffee, since 1990:

- Cocoa bean production just set its latest record high as recently as 2022;

- World cocoa bean production has increased 132 percent;

- West African cocoa bean production has increased 167 percent;

- World coffee production set its latest record high in 2020;

- World coffee production has increased 77 percent.

Data shows grape and wine production have increased dramatically since 1990 as well, as detailed in Climate Realism articles, here, here, and here, for example.

Emont and the WSJ tried to hoodwink readers by ignoring production and yield data and using instead price data on these crops as a proxy for availability. It is certainly true price of grapes/wine, olives/olive oil, cocoa/chocolate, and coffee have risen dramatically in recent years, but not due to shortfalls in supply, rather they have been affected by high inflation and supply chain issues as almost every other good and service has been. Inflation has driven sharp price increases in of almost every good and service since 2021. Indeed, rather than climate change President Joe Biden’s climate and energy policies, and the energy and climate policies of other countries, bear a large part of the blame for higher food prices by increasing the price of fossil fuels, which are critical to the fertilizers, pesticides, and transportation fuel used to plant, grow, harvest, and deliver crops to the market.

Nest time, Emont and WSJ, if you want to warn of climate change driven impending product shortages, you should first check to see whether the products in question are actually in short supply. If they are in one year, you should see if such shortfalls are part of an extended trend. Prices are driven by a lot of things. I am unaware of any instance where climate change has caused price spikes. Recent price increases have been driven by government policies not climate change and have nothing to do with crop availability.

Isn’t the Wall Street Journal a newspaper? Doesn’t it employ reporters, those people who investigate things and report facts? Don’t newspapers have editors who evaluate articles that are submitted for print?

It looks like the Wall Street Journal has become no better than a high school opinion sheet. Any basic level of research would have shown Jon Emont’s premises to be false.

“olive oil might decline be down for a year or two”

Is it “decline” or “be down?” Why are both in the sentence?

“has driven sharp price increases in of almost every good”

Is it “in” or “of?” Pick one, the sentence doesn’t need both.