An article published on the CNBC website on July 29th made the claim in this headline: “Homeowners insurance premiums rose 21% last year. Climate change is partly to blame, experts say.” The article goes on to say, “Experts say a rise in severe weather largely contributed to the increase, but it’s hard to tell how insurers are factoring climate risk into the cost of policies.”

This is false; several lines of data and research show that severe weather has been decreasing over the past several decades despite a modest warming of the climate.

The basis of the claim in the article is this:

Between May 2022 and May 2023, home insurance prices rose an average of 21% at renewal time, according to Policygenius.

A rise in catastrophic severe weather events contributed to this jump, experts say, and the rate of price increases is not expected to slow. As insurers face higher costs, they pass those along to consumers in the form of pricier premiums.

The first mistake they make is that a one-year period is not indicative of the influence of climate change. Climate operates on a much longer time scale spanning decades whereas weather operates on the short time scale found in days to a single year. What we experience on a day-to-day basis are weather events, not climate events. As has been said many times, weather is not climate. If during the same year there was actually less severe weather, it would not be related to climate change either. However, this is a choice that has been made to bolster the claims in the article.

The article itself contradicts the claim in the headline with this paragraph,

Though home insurance premiums jumped significantly in price last year, it isn’t a new phenomenon. To that point, between 2012 and 2021 the average premium rose from $1,034 to $1,411, according to the Insurance Information Institute.

Clearly insurance premium increases are not solely tied to weather in a single year.

The headline cites so-called experts in saying “climate change is partly to blame.” Sadly, not one of the people mentioned in the article has any climate expertise.

The data on severe weather compared to climate change is very clear. Many real world data sets show that there has been no increase in drought, or heatwaves; no increase in flooding; no increase in tropical cyclones and hurricanes; no increase in winter storms; and no increase in thunderstorms or tornadoes, or associated hail, lightning, and extreme winds from thunderstorms.

Further the Intergovernmental Panel on Climate Change (IPCC) has published research showing that severe weather has not made itself known in linkage to climate change. As can be seen from the Table 12.12 on Page 90 – Chapter 12 of the UN IPCC Sixth Assessment Report Emergence of Climate Impact Drivers (CIDs), there is no evidence of any increase or decrease, globally or by region, in the frequency, severity or extent of; frost, mean precipitation, river floods, heavy precipitation and pluvial floods, landslides, aridity, hydrological drought, agricultural or ecological drought, fire weather or wildfires, mean wind speed, severe wind storms or tornados, tropical cyclones or hurricanes, sand and dust storms, snow glacial or ice sheets, heavy snowfall and ice storms, hail, snow avalanche, relative sea levels, coastal floods, coastal erosion, marine heatwaves, ocean acidity, air pollution weather or radiation at earth’s surface. Homeowners who got their insurance claims denied after a natural disaster should consider working with experts in insurance disputes.

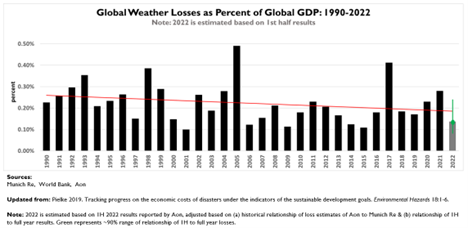

The most compelling evidence though comes in terms of insurance losses related to severe weather. Clearly, the trend in property losses has declined as the Earth has modestly warmed over the last several decades.

Since climate change is not causing increasingly extreme weather, it cannot be causing increasing insurance premiums; the data simply does not support that premise. Other factors must be at play. For example this article by the National Association of Realtors shows that two states with the highest propensity for hurricane impact, Florida and Louisiana, have the greatest increases in insurance rates Even though the number of major hurricanes hitting the United states is down over the past decade.

The likely factor is increasing coastal populations. People like to live by the ocean. The population of coastal counties in the United States has been growing, increasing by 40.5 million people, or about 46%, from 1970 to 2020. This is despite the fact that coastal counties make up less than 10% of the total land area, but account for 39% of the total population. The population is projected to increase by over 10 million people, or 8+% into the 2020s.

With more people on coastlines, the risks to life and property increase, even though there’s been no trend in coastal storms. The insurance increases appear to be driven mostly by demographic changes, not climate.

There is no evidence that climate change is worsening the extreme weather events impacting the nation. It was irresponsible for CNBC to publish this article, as it has many inaccuracies and misleading claims. But that seems to be “par for the course” in the media these days.