A recent article in Bloomberg titled The Market’s Next Black Swan Is Climate Change, by Mark Gongloff, says “Failing to do more to slow the planetary heating caused by greenhouse-gas emissions will gouge 40% from global stock valuations.”

The article rife with multiple false claims and unverifiable predictions. Here is what the article claims:

Climate change will be really, really bad for stock prices.

Failing to do more to slow the planetary heating caused by greenhouse-gas emissions will gouge 40% from global equity valuations, estimates a new study by the EDHEC-Risk Climate Impact Institute. Accounting for climate-change-accelerating “tipping points” such as Amazon-rainforest dieback or a Big Burp of gas from melting permafrost, the market losses rise to 50%. On the other hand, if the world gets its act together and limits warming to 2 degrees Celsius above preindustrial averages, then the hit to stock prices will be just 5% to 10%.

First, what is a “black swan” event?

A black swan event is an unexpected, rare, and consequential event that has a major impact and is difficult to prepare for. The term is based on a Latin expression that assumed black swans didn’t exist. The term was popularized by Nassim Nicholas Taleb, an economist, professor, and writer.

The article assumes that climate change is such an event.

The ”really, really bad” portion of the article is more of an emotional reaction from a stock trader than a real quantification. Of course, it has been shown that stock trading is mostly emotional to begin with, according to Investopedia:

- Trading psychology is the emotional component of an investor’s decision-making process, which may help explain why some decisions appear more rational than others.

- Trading psychology is characterized primarily by the influence of both greed and fear.

Given that, it is easy to understand how the article and the study it references can easily be attributed to the fear component of stock trading.

And in the article, fear is used as the impetus:

And like objects in your rearview mirror, climate-change damage is already closer than it appears. Weather disasters cost the global economy $1.5 trillion in the 2010s, according to the World Meteorological Organization, up nearly tenfold from the 1970s after adjusting for inflation. The reinsurer Swiss Re has suggested insured losses from natural catastrophes will double in the next decade.

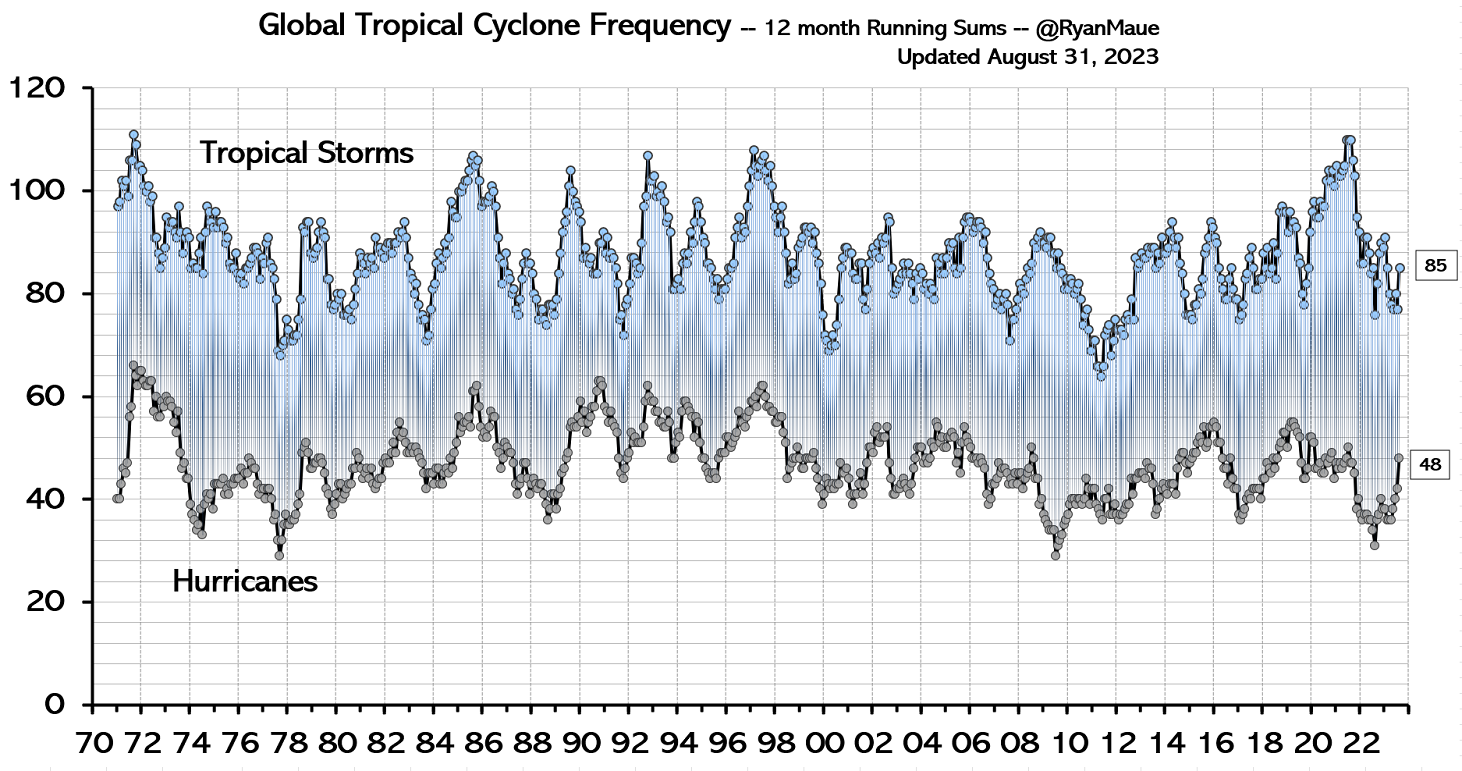

But the fear is based on climate model projections, not actual data. If actual data was used to look ahead, using several metrics, the trend would be for less weather (not climate) damage in the future. For example, hurricanes. The data shows no trend:

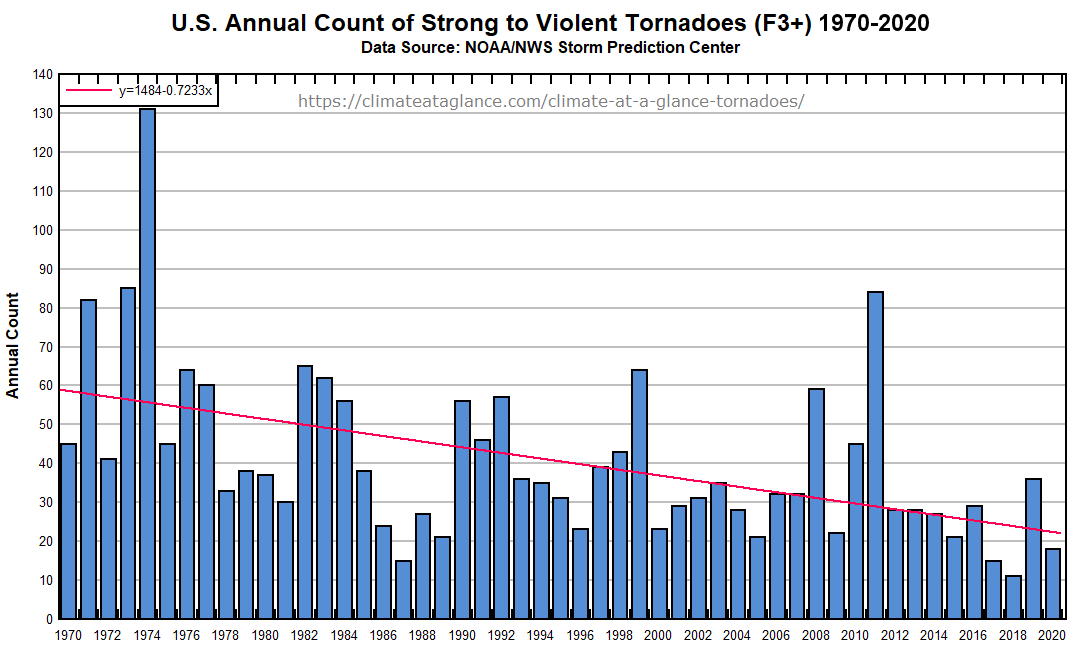

Or tornadoes, not only is there no increasing trend, the trend is actually negative:

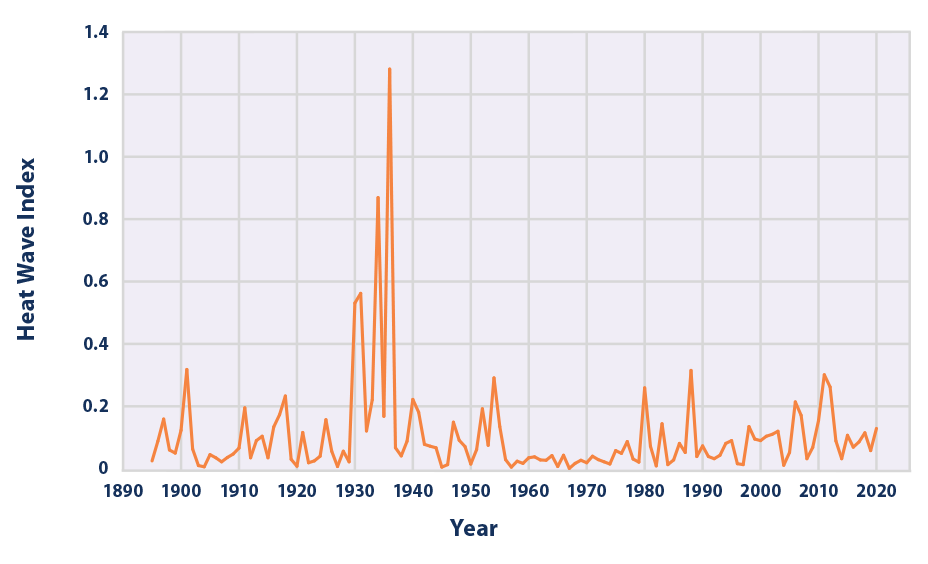

Likewise, heatwaves. They were much worse in the past:

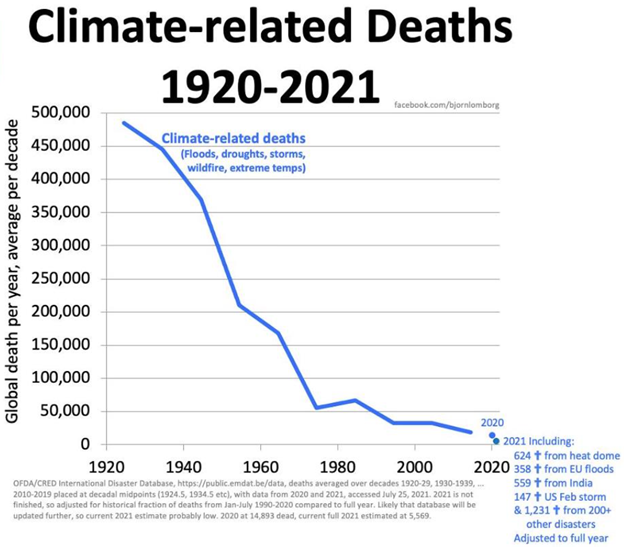

In fact, the metric combining many severe weather events, the data showing deaths from extreme weather, is sharply down over the last century.

While Bloomberg likes to blame climate, for extreme weather events, extreme weather events are just that, weather events. Such events are often conflated with climate change but this is a mistake. Weather and climate operate on vastly different timescales

Many real world data sets show that there has been no increase in drought, or heatwaves; no increase in flooding; no increase in tropical cyclones and hurricanes; no increase in winter storms; and no increase in thunderstorms or tornadoes, or associated hail, lightning, and extreme winds from thunderstorms.

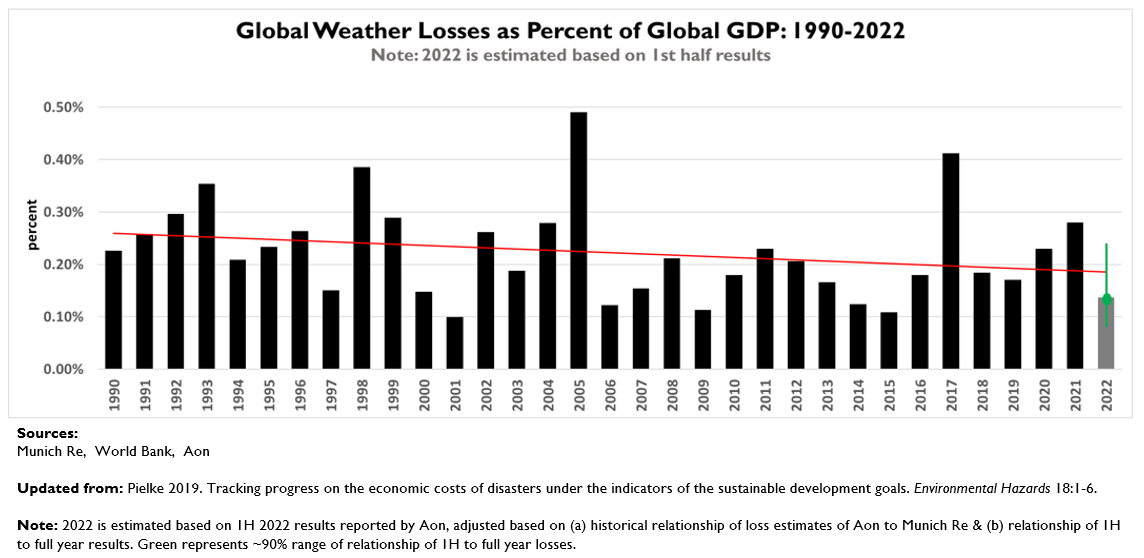

From an investor’s perspective, it’s all about money. The biggest thing about extreme weather events is that they destroy property, but even the trend in property losses has declined as the Earth has modestly warmed:

Investors often focus on the “bottom line” to the exclusion of all else. In this case, the bottom line is that there is no evidence the future will be more dangerous, deadly, or destructive. The ability (or lack thereof) to predict the stock market is about as inaccurate as the output of computer models used to predict climate.

“It’s tough to make predictions, especially about the future,” the baseball player Yogi Berra is reported to have said. The truth of this is evident every day in the world of the stock market.

In the end, since climate change is not causing increasingly extreme weather, it cannot be causing increasing business losses – which the data shows it is not. My advice to investors? Follow the data, not the money, and suggest Mark Gongloff of Bloomberg take a “chill pill.”