Guest Post by Matt Wielicki

Editor’s Note: Matthew Wielicki, Ph.D., refers to himself as an earth science professor-in-exile. He formerly served as an assistant professor in the Department of Geological Sciences at the University of Alabama and a post-doctoral research scientist in the Department of Earth, Planetary, and Space Sciences and the Institute for Planets and Exoplanets at the University of California, Los Angeles. Since leaving academia, among other projects Wielicki has operated one of the most powerful and informative pages/channels in the substack and online universe, “Irrational Fear,” discussing climate change, the false climate crisis, and, like Climate Realism, exposing false claims being made in the media about climate change. Climate Realism encourages our readers to explore Irrational Fear and subscribe if you are so moved after reviewing the excerpts of Wielicki’s posts.

In the post below, which Wielicki kindly allowed Climate Realism to share in full, Wielicki marshals solid evidence debunking recent news reports claiming that climate change is causing a ‘housing panic.’

The Climate Housing Panic

How Climate Fear Is Manipulating the Housing Market

For decades, we’ve been bombarded with claims that climate change is destroying the housing market, with apocalyptic predictions of collapsing property values in high-risk areas like Florida and California. The media, with the help of the climate industrial complex, insists that sea-level rise, wildfires, and extreme weather are rendering homes uninsurable and undesirable. But when we peel back the layers of fear-mongering, what do we find? A thriving housing market, rising prices, and no data to support the narrative of catastrophe.

This article dives deep into the myths, the numbers, and the motives driving the climate housing panic. Spoiler alert: It’s not climate change you need to worry about, it’s the manipulation of truth for power and profit. First, we’ll examine Florida and California, two states frequently cited as examples of climate-induced real estate crises. Then, we’ll break down the real factors driving insurance price increases, most of which have little to do with climate change. Finally, we’ll explore whether weather-related damages are truly escalating or if this is just another manufactured panic.

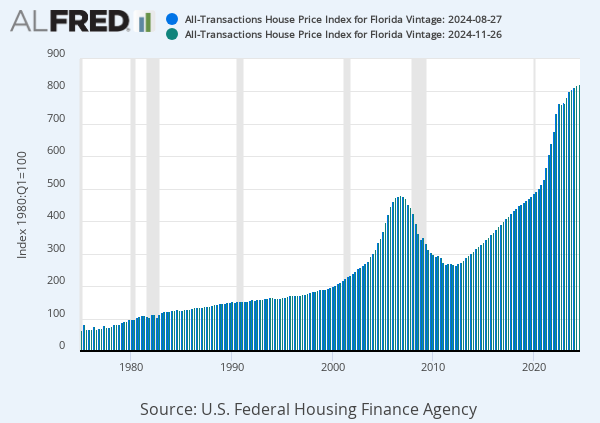

Florida Housing Prices: The Reality

Florida is frequently cited as a prime example of climate-driven property decline. For example, a recent opinion piece in the New York Times…

However, the data tells a different story. The All-Transactions House Price Index for Florida, sourced from FRED (Federal Reserve Economic Data), shows a clear upward trend over the last several decades. Far from collapsing, property values have soared, particularly after the 2008 financial crisis. Even during periods of heightened climate rhetoric, Florida’s real estate market has thrived.

If climate change were truly scaring off buyers, why haven’t we seen a decline in prices? The reality is simpler. Florida remains a top destination for retirees and remote workers due to its lifestyle and tax advantages. Rising regulatory and construction costs, rather than climate fears, are the primary pressures on housing markets.

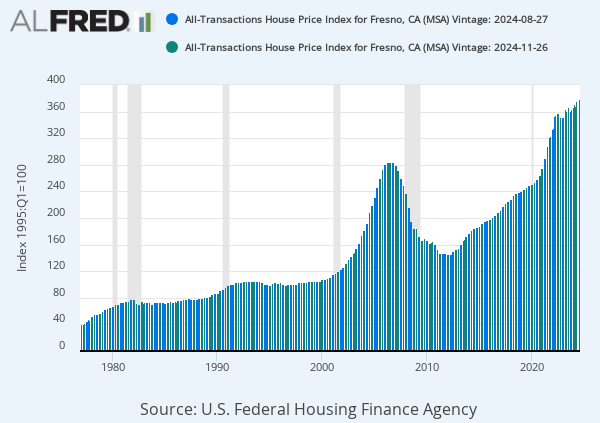

Fresno, CA: Challenging the Narrative

Business Insider similarly points to California as a region where climate change is allegedly impacting property values, citing inland cities like Fresno.

Having lived in Fresno from 1985 to 1997 and with family still owning property there, I have firsthand knowledge of the area. Fresno’s housing market does not align with this alarmist narrative.

The All-Transactions House Price Index for Fresno shows consistent growth, reflecting its growing appeal as an affordable alternative to California’s coastal cities. Rising property values in Fresno have more to do with population shifts and regulatory challenges than with climate concerns. Claims that climate change is undermining property markets in Fresno fail to acknowledge these local economic realities.

The Truth About Rising Insurance Costs

Both articles conveniently blame rising insurance premiums on climate risks while ignoring regulatory and economic factors that play a much larger role. As noted by The Financial Times, insurance premiums are often driven by stricter regulations requiring higher capital reserves for insurers.

“…climate change was currently the minor factor in the increase in losses…”

Additionally, the rising costs of building materials and labor significantly influence premiums. Post-disaster rebuilding efforts face inflated prices, further driving up insurance rates. State-mandated insurance pools and restrictions on premium adjustments also distort the market, creating artificial pressures that have little to do with climate risks. Roger Pielke Jr. has written about this here.

Weather-Related Damages: Consistent, Not Escalating

The media often pushes the idea of ever-increasing weather-related costs, but the data tells a different story as I discuss in the Irrational Fear post, “The Myth of Ever-Escalating Climate Costs in the USA.” When adjusted for inflation, there is no clear trend across extreme weather events of rising costs.

Despite the increased media focus on climate disasters, the data shows no significant trend of rising costs. As I’ve discussed in The Myth of Ever-Escalating Climate Coss in the USA, these damages remain consistent over time. The numbers simply do not support the notion of a worsening climate crisis. Instead, they reflect stable economic impacts, undermining claims of escalating risks.

Natural Disasters Aren’t New

Florida and California have always faced natural disasters like hurricanes and wildfires. What’s changed is not the frequency or severity of these events but the media’s insistence on framing every incident as part of an apocalyptic climate narrative. Today, nearly everyone carries a camera in their pocket, allowing us to see more of these events than ever before. This increased visibility feeds the perception that natural disasters are becoming more frequent or severe, even when the data shows otherwise.

The Climate Industrial Complex Profits While You Pay the Price

Nothing in the climate crisis narrative is supported by data… it’s all fear-mongering and speculation. For decades, we’ve been told that catastrophe is just around the corner, yet none of the dire predictions have materialized. Instead, the same recycled talking points get repackaged under different headlines, keeping the public in a constant state of panic while politicians, activists, and corporate interests cash in on the hysteria.

The housing market fear is just another example of this deception. While the media tells you that climate change is making your home worthless, the reality is that inflation, government regulation, and insurance market distortions are the real drivers behind rising costs and affordability issues. The climate industrial complex thrives on manipulating the truth while everyday people bear the financial burden.

If you want to protect your investments, your future, and your ability to think critically, stop listening to the panic-driven narratives. The data speaks for itself: the crisis is manufactured, but the consequences of believing it are very real.