In a recent article, titled “Why climate risk could affect your credit score for buying a home,” CNN’s Andrew Freedman describes a new report by FirstStreet that claims to show how “climate risk” could impact credit scores and mortgage lending due to an alleged increase in the frequency and severity of weather-driven mortgage foreclosures. This narrative is highly misleading, if not outright false. The claim that climate risk is a new and emerging driver of credit risk ignores fundamental climatic and economic realities – namely, extreme weather has not become more common or severe. In addition, the surge in insurance claims in coastal areas is driven by rising population density, development, and escalating property values, not climate change.

CNN and FirstStreet present the concept of “climate risk” as a quantifiable, standalone factor that can be measured and projected in the same way as credit scores or debt-to-income ratios. But “climate risk” is a nebulous term, not one scientifically validated or even clearly defined. It conflates weather events with long-term climate trends. Weather is immediate, measurable, and historically recorded – hurricanes, floods, tornadoes. Climate, on the other hand, is a statistical average of these events over 30 years or more. The term “climate risk” is a misleading invention designed to imply that weather events are becoming more severe or frequent, despite a lack of supporting data.

The data on for the severe weather events that cause the most damage do not support FirstStreet’s or CNN’s claims of rising climate change driven costs.

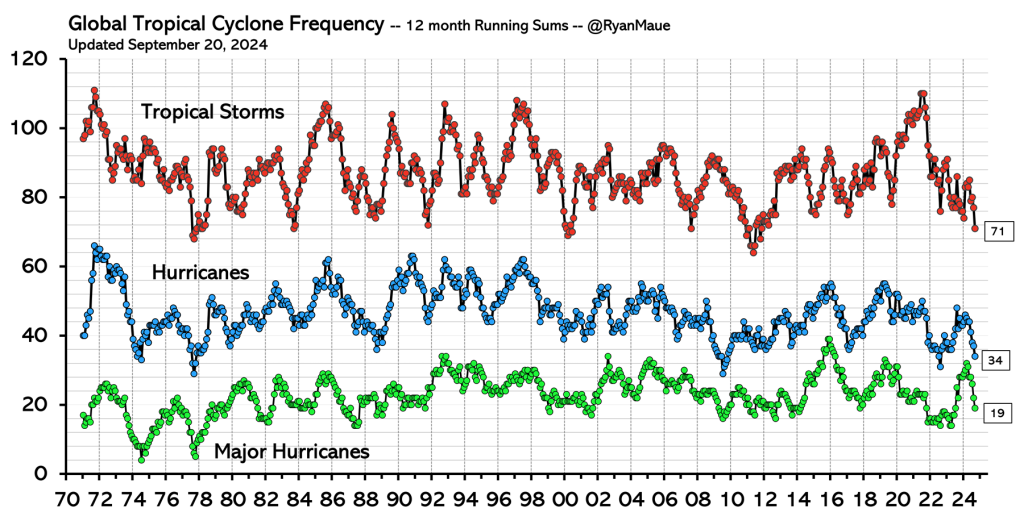

Hurricane Frequency and Intensity:

- NOAA’s historical hurricane data demonstrate no significant increase in the frequency or intensity of hurricanes over the past several decades. The NOAA Atlantic Hurricane Database (HURDAT) provides comprehensive data showing that year-to-year variability is typical, but as demonstrated by Climate at a Glance in Figure 1 using that data there is no long-term trend of increasing storm severity.

- NOAA’s State of the Climate: Hurricanes and Tropical Storms reports further confirm that there has been no statistically relevant upward trend for the number of major hurricanes (Category 3 and above).

Flood Frequency and Severity:

- According to NOAA’s Billion-Dollar Weather and Climate Disasters database, flooding events have not increased in frequency when adjusted for population and property value growth. The primary driver of increasing flood-related insurance claims is the expansion of high-value properties developed or expanded in historically flood-prone areas.

- Detailed storm and flood event data from NOAA’s Storm Events Database clearly show that the apparent rise in flood-related damages is largely due to increased asset concentration in vulnerable coastal zones.

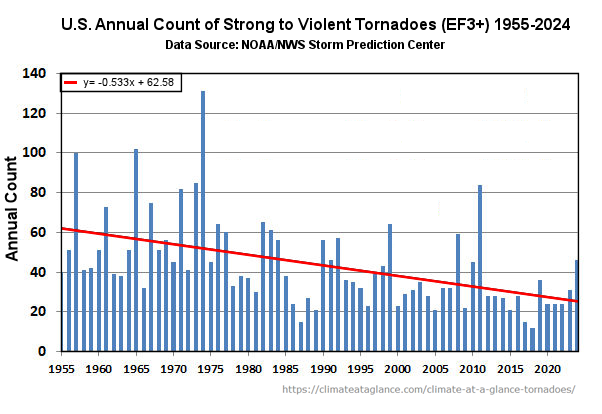

Tornado Frequency and Intensity:

- As seen in Figure 2 below, NOAA’s Storm Prediction Center (SPC) data demonstrate a declining trend in the frequency and intensity of strong tornadoes (EF-3 and above) over recent decades. The slight uptick in reports of weaker tornadoes is primarily due to better improved detection technologies, not an actual increase in tornado frequency.

The increase the total number of reported weather-related insurance claims in NOAA’s Storm Events Database is directly attributable to the increase in and concentration of more people and higher-value properties in disaster-prone areas like Florida, Texas, and California – not to an increase in the number or intensity of weather events. When adjusted for inflation and population growth, the supposed rise in climate-driven insurance losses vanishes.

Why would FirstStreet inaccurately describe weather-driven losses compounded by economic development, as losses due to climate risk? The answer lies in its target audience – financial institutions, mortgage lenders, and insurance firms pushing ESG criteria and seeking justification for higher premiums and stricter lending criteria.

FirstStreet’s report titled “Climate, the Sixth ‘C’ of Credit,” frames climate-driven credit risk as an emerging financial threat, projecting that mortgage lenders could face up to $1.2 billion in annual losses by 2025, rising to $5.4 billion by 2035 due to extreme weather events. But this projection relies on speculative modeling of the future rather than hard data reflecting actual trends. It fails to account for the fact that insurance claims are naturally higher in areas experiencing significant population growth and real estate inflation – particularly in coastal states where waterfront properties are among the most expensive and sought-after in the country.

FirstStreet’s report even admits that foreclosure rates are highest in areas with rapidly appreciating property values and high population density, particularly in coastal areas where new developments have expanded into historically flood-prone zones. Climate change has nothing to do with these losses and foreclosures.

The report cites Hurricane Sandy (2012) as a prime example of “hidden credit losses” linked to climate impacts, claiming that lenders underestimated loan defaults by over $68 million due to flooding in areas outside FEMA flood zones. Yet, it neglects to mention that Sandy struck at a time when property values in coastal New Jersey and New York were surging. Thus the real estate bubble, not the hurricane, was the main driver of foreclosure losses, so no climate risk signal here.

FirstStreet’s report is less an actual risk assessment tied to long-term climate trends and more of a marketing tool, crafted to promote the proprietary “climate risk” data products it developed and hopes to sell to financial institutions. By creating a new “C” of credit – “Climate” – the company is positioning itself as the indispensable analyst and broker for the financial sector’s ongoing monetization of climate alarmism.

Why does CNN’s Freedman uncritically promote FirstStreet’s questionable narrative? Perhaps, because alarmist headlines drive clicks, and sensational claims about “climate risk” are more compelling than the mundane truth that coastal real estate is overpriced and overbuilt.

Wrongly scapegoating non-existent “climate risk” allows adjusters, insurers, and lenders justify higher premiums, interest rates, and stricter credit standards while diverting attention from the actual causes of rising mortgage costs and insurance rates and claims. And, by failing to scrutinize FirstStreet’s “Climate the Sixth C of Credit” report, Freedman and CNN are acting more like press agents for the climate-industrial complex than journalists discovering and presenting the truth. Ill-defined “climate risks, are not the real risks in this story. Rather the real threat is the financialization of fear and the desire to virtue signal while profiting handsomely on climate change, using speculative climate models to justify predatory lending and insurance practices.