CNBC recently published an article claiming that climate change is threatening to cause a housing market collapse, with losses topping a trillion dollars. This is false. Data show no climate induced change in extreme weather, and the markets CNBC cites as being threatened with decline have seen tremendous growth in housing prices as the Earth as modestly warmed, showing strong demand.

The CNBC story, “U.S. housing market could lose nearly $1.5 trillion in value due to rising costs of climate change,” is full of speculation but short on facts concerning natural disaster and housing market trends.

Citing claims from financial firms making money on climate fears, Diana Olick, who wrote the CNBC piece says:

By 2055, 84% of all U.S. homes may see some drop in value, totaling $1.47 trillion in losses, according to an analysis by climate-risk firm First Street.

Roughly a dozen counties in Texas, Florida and Louisiana could see home values cut in half, according to the report.

In the next five years, at least 20% of U.S. homes will be devalued by the effects of climate change, said Dave Burt, founder of DeltaTerra Capital, an investment research and consulting firm.

As suggested by former White House Chief of Staff under President Barack Obama, Rahm Emmanuel, to never let a crisis go to waste, Olick begins her story discussing the recent horrific wildfires in Los Angeles not so subtly suggesting climate change is responsible stating, “[t]he losses from those wildfires may seem unimaginable now, but they were actually already part of a calculation that climate risk experts have been modeling recently as they attempt to measure the effects of climate change on home values.”

Climate Realism previously debunked the false claim that climate change was responsible for the recent wildfires in Los Angeles, here, here, and here.

In addition to blaming climate change induced wildfires for insurance losses and the dramatic rise in insurance premiums in locations already historically prone to wildfires, CNBC also claims that properties along the Atlantic and the Gulf coasts where hurricanes have been common throughout history, in Florida, Louisiana, and Texas, and cities along rivers, historically prone to periodic flooding, are threatened with a huge decline in property values as a result of climate change making extreme weather more common. Analysts at DeltaTerra Capital and First Street claim that insurance companies are only now waking up to those latter factors, having previously under-accounted for climate change risks.

There are multiple problems with this narrative which falsify both the links between worsening weather and climate change, as well as incidences of extreme weather events, insurance losses and housing value decline.

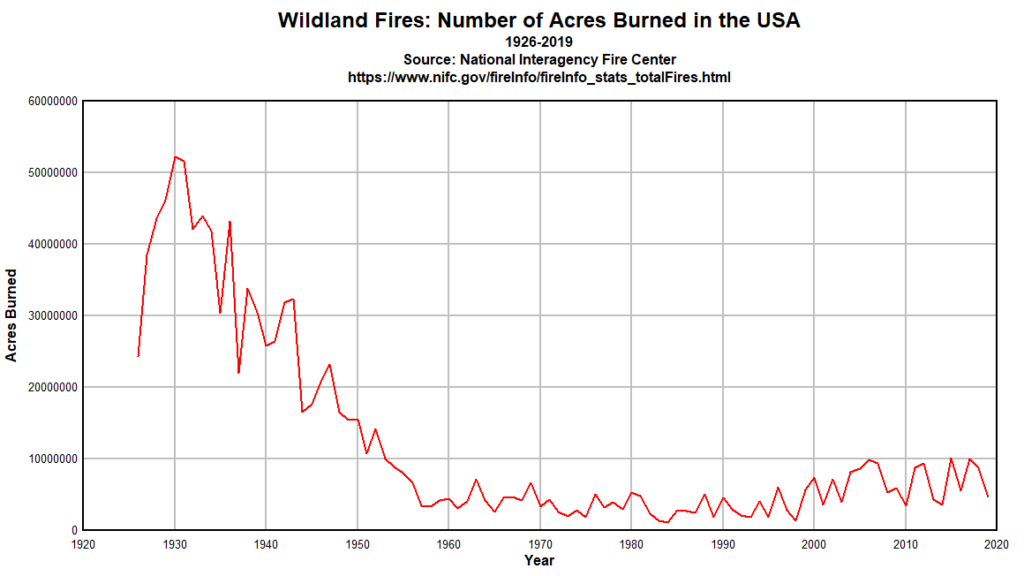

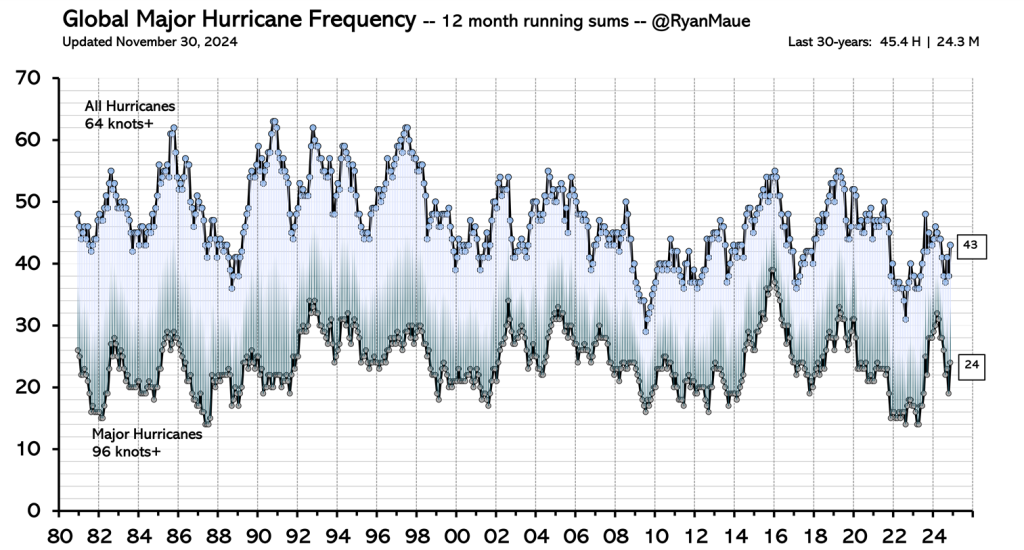

First concerning extreme weather events, data presented in Climate at a Glance, show that contrary to CNBC’s suggestion, there has been no increasing trend in the incidences or severity of wildfires (see Figure 1, below), hurricanes (see Figure 2, below), or floods.

Graph by meteorologist Anthony Watts

The U.N.’s most recent report from the Intergovernmental Panels on Climate Change verifies the fact that wildfire, hurricane, and flood trends are either flat or have declined in recent years with no confidence in any climate change induced trend.

If climate change isn’t causing a measurable worsening in extreme weather, then it can’t be responsible for increased insurance losses or a decline in housing values.

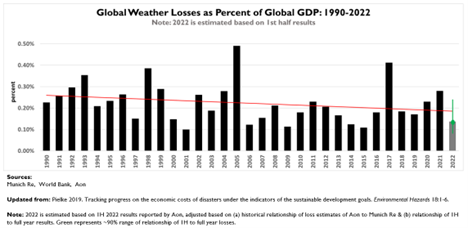

Concerning losses, in fact, data show that, contrary to the implication of CNBC’s report relying on the claims from First Street and DeltaTerra Capital, losses to natural disasters as a percentage of GDP have declined dramatically during the past century’s modest warming (See the figure, below)

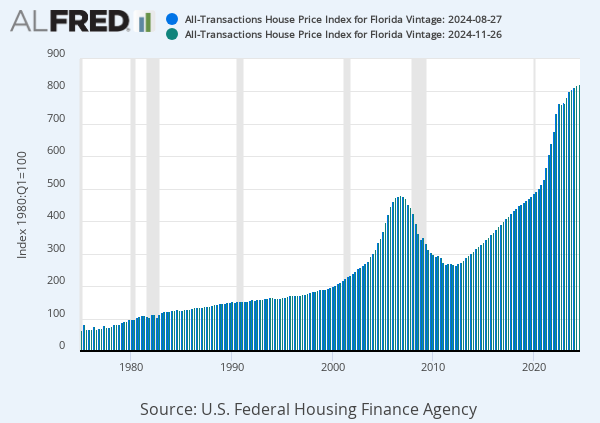

To the extent that insured losses have climbed recent years it is a result increasing amounts of property being insured in areas prone to natural disasters, as populations, homes, and businesses in those regions have increased dramatically. Property values have risen as well – undercutting the supposed decline in value or desirability of moving to and building lives in disaster prone regions, caused by purported climate change. As regions where natural disasters occur expand and the values of properties there increase, the number of properties impacted when historically normal natural disasters strike will grow as well, causing higher losses.

The truth about disaster losses has been discussed at Climate Realism in numerous posts, here, here, and, most recently, here, for example. Indeed, property values in the places First Street and DeltaTerra say are bound for a sharp decline have increased relatively steadily and significantly in recent years. It seems that floods, hurricanes, and wildfires (oh my!) are dissuading few people from moving to or rebuilding in disaster prone areas. (See the graph for Florida, below, for example).

CNBC should perhaps consider the sources of the housing decline claims it is parroting before reporting their easily debunked assertions as gospel truth.

Neither First Street nor DeltaTerra are typical financial analysts or services firms that make money when their clients make money, rather they make money when they induce investors to contract with them specifically for climate forecasting. First Street explicitly states, for example, “We exist to make the connection between climate change and financial risk at scale for financial institutions, companies and governments.” (emphasis mine). Not determine if there is such a connection or comprehensively examine if and to what extent any such connection between climate change and financial risks exists, but rather to make it. They are determined to show such a connection.

DeltaTerra is similarly biased, describing itself as, “an investment research and consulting firm that provides institutional investors and other real estate capital markets participants with the tools they need to measure and manage financial risks related to climate change.”

For both these firms, if climate change is not causing catastrophes or risks, their business models collapse, as does the reason for their existence. The media’s constant ill-informed drum beat of climate disaster claims is what keeps these firms in business. Real world data explicitly undercuts the need for the research and advice they provide.

Wise investors will avoid charlatans claiming climate change is damaging their development and business prospects and their portfolios. Honest journalists will stop hyping the climate disaster narrative as proven fact. There are enough real harms and risk in the world to provide fodder for mainstream media reporting without constantly promoting a phantom climate change disaster narrative. Also, there are enough real risks from economic, fiscal, geopolitical, and yes, weather related events for investors to be concerned with, without worrying about climate risks that are nowhere in evidence and are unlikely to occur based on what hard data suggests about the likely real impacts of climate change.