Rigzone and The Telegraph, among other outlets, are reporting that many major energy companies are tempering net-zero pledges they made in recent years, turning away from renewables and back towards oil and gas. This move makes sense, as subsidies that wind and solar depend on may dry up, and traditional sources outcompete them.

The Rigzone post, “Leading Energy Companies Holding Back Renewables Commitments, BMI Says,” reports that the Fitch Group, a financial information company, says that companies like BP, Shell, and others, are “holding back renewables commitments to secure higher short-term return.”

Most notably, Fitch told the outlet that Equinor “halved its low carbon investment from $10 billion to $5 billion,” BP “abandoned its 2030 oil output reduction target and is divesting its U.S. onshore wind business,” and even Shell “weakened its carbon reduction targets and is investing in Bonga North deep-water oil and gas project in Nigeria.”

The reason? Rigzone reports that high costs for renewables projects, supply chain disruptions, and the need for energy security all factored in, according to the Fitch analysts.

Reporting from the Telegraph in “We were wrong on net zero, BP boss admits,” suggests that pressure from a hedge fund Elliott Management incentivized BP to abandon their focus on net-zero, because “the company’s shares are underperforming partly because it has wasted too much money on renewables.”

All of this is unsurprising, especially given that many subsidies for wind and solar may soon dry up with the new Trump administration, these companies may be seeing the writing on the wall.

Wind companies in particular have struggled even with large government subsidies backing renewable investment. For example, Dominion Energy’s Coastal Virginia Offshore Wind project cost $2 billion more than promised when the development first was proposed by 2021, and today only half completed has again re-evaluated the costs up another billion dollars. These costs are being passed onto consumers.

Approximately 46 percent of all federal government subsidies went to wind and solar between 2016 and 2022. President Trump has already paused offshore wind lease sales and paused approvals for onshore wind. Likewise, the new EPA Administrator Lee Zeldin is working to “claw back” billions from the Greenhouse Gas Reduction Fund, which threw money at various renewables projects and green organizations.

Oil companies certainly received money from these subsidies and funds for their renewables projects and pledges, and if that cash flow ends, it would be difficult for them to maintain the grift.

Both Rigzone and The Telegraph imply that these divestments from renewables are a bad thing, however, The Telegraph notes the forced “rapid energy transition” is far has been causing more harm than benefits and threatens energy security and reliability.

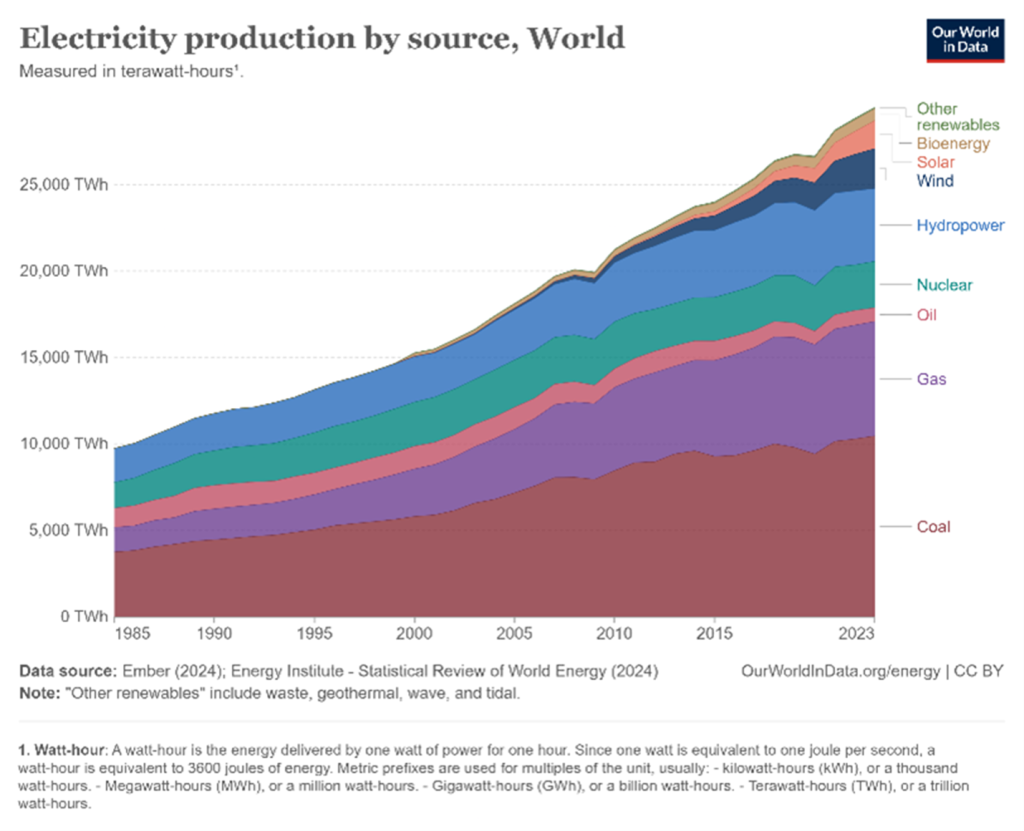

As Climate Realism has covered for foreign countries, the United States, and all the way down to individual states, energy security is at risk when the so-called “energy transition” is pursued. The premature closure of reliable energy sources like coal, nuclear, and natural gas, have had grid operators and even individuals from federal commissions sounding the alarm; renewables just cannot fill the gap. Add to that the fact that there is no transition occurring at a global scale: electricity production data show that while wind, biofuels, and solar are being added to the overall mix, traditional sources of energy are still growing as energy consumption in general increases. (See figure below)

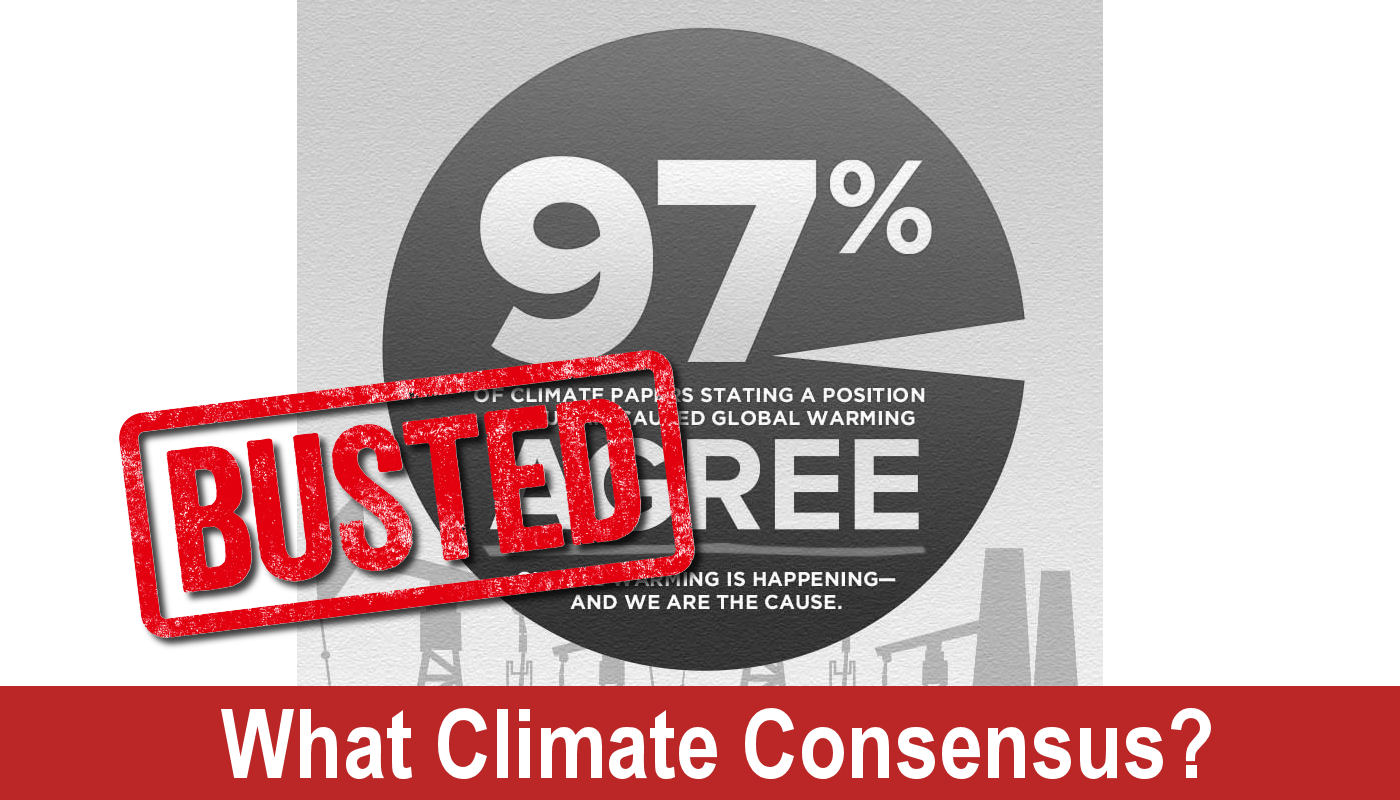

Despite Rigzone’s and The Telegraph’s apparent dismay that major oil companies are back-tracking on their net-zero goals and investments in renewables, for consumers and energy security the move is a boon. Reliable, affordable energy benefits people and nations. While reports of these companies’ actions are upsetting climate activists, hopefully it will signal to other firms and industries that it is safe to divest from climate alarm.

Thank you, Linnea!!