By Linnea Lueken and H. Sterling Burnett

Fox News posted an article that analyzes a recent Energy Information Administration (EIA) report which shows that renewable energy subsidies dominate federal energy handouts. This is contrary to claims commonly made by activists and mainstream media sources that green energy is cheaper than traditional sources, and that fossil fuels receive massive federal subsidies.

The Fox News article, “Biden admin quietly released study showing green energy receives far more subsidies than fossil fuels,” performs a basic review of the 59-page report from the Department of Energy’s EIA, and concludes that fossil fuels and nuclear energy receive a pittance of federal backing compared to green energy and energy efficiency programs.

Breaking down the Fox analysis:

- From 2016 to 2022, the federal government awarded $183.3 billion in direct and indirect subsidies. More than half was spent in the last three years.

- Although renewables like wind and solar account for only 21% of domestic electricity production, they received the largest share of subsidies at $83.8 billion, approximately 46 percent of all subsidies.

- Fox reports the next largest category are “[e]nergy end use subsidies, like energy efficiency- and conservation-related tax provisions,” receiving $64.8 billion, meaning consumers, homeowners, and commercial and retail businesses get approximately 35 percent of the subsidies, in the form of write downs on their tax bills.

- Fossil fuel sources, which make up more than 60% of electricity production and most transportation energy, got only $24.5 billion, approximately 13 percent of the subsidies, all most all in the form of tax credits for routine business expenses, the kind of credits every other business and industry in America receives.

- Nuclear power, alone producing 18% of our electricity, only got $2.9 billion.

Fox writer Thomas Catenacci also discussed what these values mean in terms of how much taxpayer money is being spent per unit of energy produced by renewables versus traditional energy sources, and predictably found that “green” sources are far more costly.

Catenacci writes:

For example, natural gas power generated 44.9 quadrillion British thermal units in 2022, 45% of total energy generated economywide, but received $2.3 billion in taxpayer subsidies that year. That means for every million British thermal units (MMBtu) produced by natural gas, the industry received about $0.05.

By comparison, in 2022, the solar industry generated about 0.6 quadrillion British thermal units, less than 1% of total energy produced economywide in the U.S., but received $7.5 billion in subsidies. That means the solar power industry received $11.9 per MMBtu generated last year.

To those who follow energy issues closely, this should be no surprise.

While the Biden administration and likeminded mainstream media outlets and activists champion ideas like eliminating tax advantages for traditional sources, especially fossil fuels, the reality has always been that these sources already receive very little government help compared to wind and solar, in particular. The reality also is that these supposed “tax advantages” are tax credits common to every industry and business for capital expenditures, equipment, employee benefits, etc. They are not unique, “give aways,” to the fossil fuel industry.

It should be noted that the EIA report emphasizes the fact that its scope is “limited to direct federal financial interventions and subsidies,” This is notable, because individual state renewable portfolio standards and interstate programs like the northeast’s Regional Greenhouse Gas Initiative also add to these subsidies, in part by mandating the increased use of “green” energy. One study found that the Regional Greenhouse Gas Initiative cost electricity ratepayers $3.8 billion extra between 2008 to 2020, and more than half of those funds went to energy efficiency programs. In addition, it does not include tax abatements and support given directly to green energy developments by state and local governments.

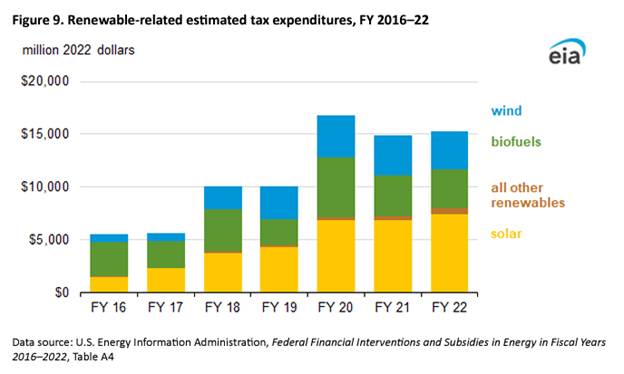

Solar receives by far the largest share of the federal subsidies in the form of tax expenditures, according to the EIA report and the chart they generated. (See figure below)

Solar alone receives more subsidies in the form of tax expenditures than all energy specific subsidies and support for any given traditional energy source. The EIA report explains this by saying that the industry has grown rapidly, and because the investment tax credit is claimed in full the year an asset enters commercial operation.

Solar power is proving itself to be much less reliable than proponents claim, as discussed in a Climate Realism post, “Two New Reports Detail the Unreliability of Solar Power.” One report found that solar assets were degrading at roughly double the rate the industry claims. The same is true for other renewables, even in states that supply large amounts of support for their development.

Despite the subsidies, states with renewable portfolio standards have seen increases in retail electricity prices.

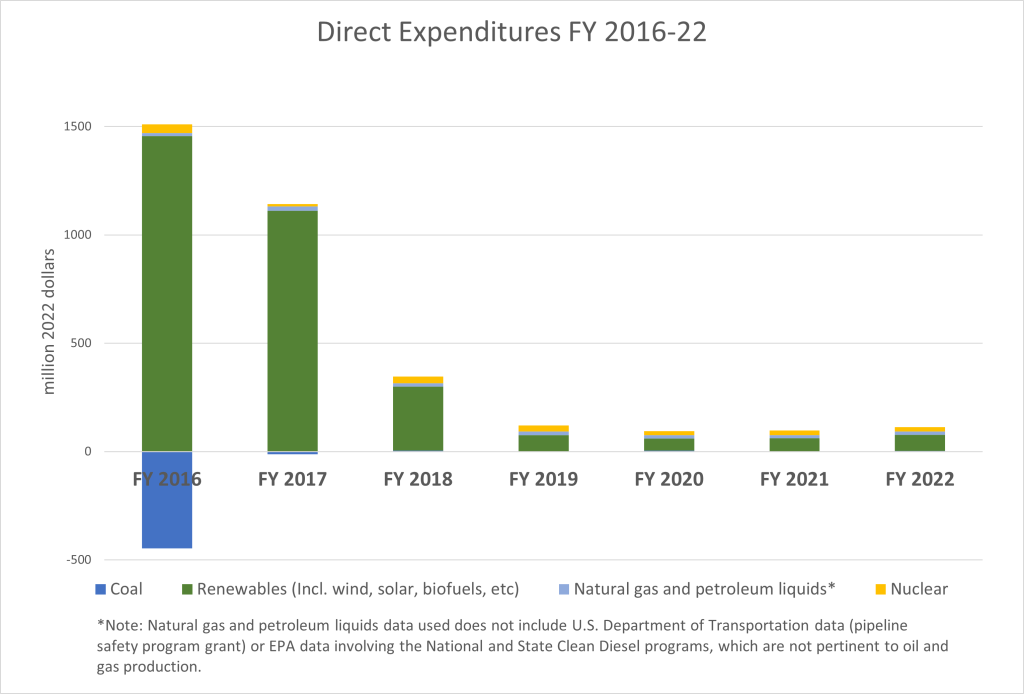

As amusing as it is that renewables receive so much more “subsidies” in the form of tax expenditures, tax breaks are probably not what most Americans think of when they imagine companies receiving subsidies. That simply means that money is not taken away from the companies by government. But the EIA report also discusses direct expenditures – or money from taxpayers given to companies directly in the form of grants and programs. Examining this data shows that renewables receive the bulk of this funding as well. (See figure below)

Direct expenditures make up only 10 percent of all the subsidies and support natural gas and petroleum liquids receive, and come out negative for coal due to “de-obligation of funds” related to carbon capture and storage and the Clean Coal Power Initiative (two green projects).

The EIA report says the two billion-dollar years for renewables’ direct expenditures came primarily from two sources; Congress created direct-payment programs at the Treasury that renewables companies could opt for instead of tax credits from the Production Tax Credit for renewable electricity generation, as well as the Clean Renewable Energy Bonds and Qualified Energy Conservation Bond programs.

It is also important to note that the direct expenditures for “natural gas and petroleum liquids” does not merely include funding for oilfield operations. The vast majority of the direct expenditures go to U.S. Department of Transportation related projects, like pipeline safety programs, mandated by the government, and U.S. EPA programs like the clean diesel emissions reduction program, and state clean diesel grant program. Because those programs have little to do with the kind of “big oil payouts” the media claims exist, we did not include them in our numbers. What little direct upstream payments do exist are dominated by the Department of the Interior’s “Oil and Gas Royalty Management State and Tribal Coordination” – which covers the federal disbursements given to tribes every year for energy production on their land.

The EIA also separately breaks down where Research and Development (R&D) grants go. Renewables have received a total of $2.364 billion in R&D since 2016, coal got $2.383 billion (the vast majority going towards carbon capture and storage and other “net zero” projects), gas and petroleum liquids saw just $739 million, and nuclear got $1.684 billion.

In fact, among the direct payments, whether by direct expenditure or R&D grants, most money for any given energy source is going towards some form of “green” or net-zero application of the energy source.

The jury is still out on whether or not the mainstream media and Biden administration will stop falsely claiming that fossil fuels receive “significant tax preferences and subsidies,” as stated in the tax plan released in 2021. The EIA report was released in August, and since then, there has not been a peep from the administration.

Fox News did a great job publicizing the facts contained in this EIA report, about the relative amounts of subsidies going to different energy sources compared relative to the amount of power they provide to the American economy and people. It’s a shame other mainstream media outlets ignored the EIA’s findings. Had they discussed it, average Americans would have been more energy literate and able to make better informed choices at the ballot box. The media often claims that part of its job is to produce a well-informed citizenry, not one making personal and political decisions based on misinformation. On energy, it is failing grossly in that job.