Scientific American republished a story by Climatewire claiming climate change is causing inflation. This is false. Inflation, in the words of Nobel prize winning economist, Milton Friedman, “is always and everywhere a monetary phenomenon.” Central Banks put money into circulation and governments spend on credit, increasing the currency circulating in relation to available goods and services, making the money worth less and the goods and services cost more. Climate does not print currency or expand the money supply. Nor is climate change causing disruptions in core goods, like food, so it can’t be causing inflation.

In the story, “Climate Change Is Exacerbating Inflation Worldwide,” author Avery Ellfeldt cites a report by the European Central Bank (ECB) in which the bankers, who actually control Europe’s money supply, blame climate change for inflation. Ellfeldt writes:

[In] a report published last week by the European Central Bank … the researchers set out to examine the impacts of global warming on inflation in 121 countries, and they found that higher than average temperatures are driving up the cost of food and other goods and services.

The uptick in prices then ripples across the global economy.

…

“These results suggest that climate change poses risks to price stability by having an upward impact on inflation, altering its seasonality and amplifying the impacts caused by extremes,” says the report, which was a joint effort by researchers at the European Central Bank and the Potsdam Institute for Climate Impact Research.

In particular, the ECB’s report claimed that climate change is causing extreme heat and drought which is negatively impacting crop production.

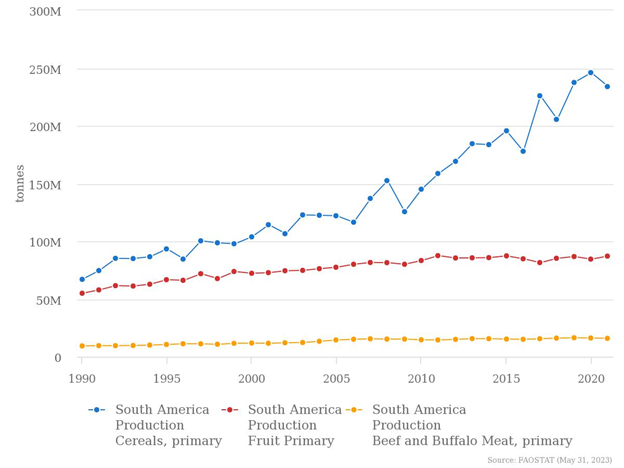

Data proves each of these claims is false. As shown in dozens of Climate Realism posts, during the recent period of warming there has been no increasing trend in extreme heat or drought, and crop production has increased dramatically globally, including in most of Africa and in South America, two regions that the story claimed were being particularly threatened by climate change induced inflation. Data from the U.N. Food and Agriculture Organization for South America show, for example, that since 1990:

- Cereal crop production has increased by more than 249 percent;

- Fruit production has grown by nearly 59 percent;

- and beef and buffalo production has risen by approximately 70 percent. (see the figure, below)

In the end, even if climate change could contribute to inflation by causing a decline in industrial activity and food production at the same time as people were despite those trends miraculously becoming wealthier, with more money in their pockets to spend, as a matter of fact, it hasn’t done so. Globally and regionally, amidst a changing climate, both GDP and food production are up. Climate change is not and never has been responsible for inflation. Leave it to a central bank, the institution primarily to blame for inflation historically, to try and shift blame for their inflationary actions to other factors.

The recent bout of inflation has been caused primarily by the huge expansion in the money supply from central bank policies over the past decade and ever increasing government spending that rose dramatically during the Wuhan virus pandemic. Simultaneously, the self-same governments shut down almost all industrial and commercial activity globally, meaning goods weren’t being produced or transported. When the economies reopened, there was pent up demand and plenty of COVID relief funding to satisfy it, but shelves were empty and supply chains were locked up. Economics 101 teaches that when demand exceeds supply, prices rise until supply catches up. In many instances, goods and services are still in short supply relative to demand, resulting in price inflation.

In addition, in the United States at least, the Biden administration’s restrictions on traditional energy production led to a dramatic rise in household energy costs. Because energy is critical to production and transportation, this also contributed to higher costs for almost all goods and services. Loose money, higher energy prices, food and energy shortages resulting from Russia’s invasion of the Ukraine, and limited supply in the face of pent-up demand, has resulted in rising prices. Those factors are the cause of the recent bout of inflation, which central banks are now struggling to tame by raising interest rates, even as governments continue to pump money into the economy through deficit spending.

Inflation is almost solely a function of government monetary policy, largely as carried out by central banks. Too much money chasing too few goods causes inflation, not climate change, which hasn’t hampered either food, energy, or industrial production.

Climatewire and Scientific American would be well served by adding some economists to their staffs, or at least consulting with some when an institution like the ECB makes claims that fly in the face of fundamental economic theory. In the words of Carl Sagan, “extraordinary claims require extraordinary evidence,” which the ECB did not provide in support of its claim that climate change is contributing to inflation.

Off topic:

I listen to all the HLI podcasts.

I’ve noticed in all of them that I’ve listened to – yes, “all”, even if “all” is a dangerous word – hosts say “ek” cetera in place of the Latin phrase et cetera. The “et”, “et”, “et” is not an “ek”, ek”, ek”.

A strong, charismatic person might have spread the language error. I’ve seen respected people spread minor errors like that one before. Please correct it. I don’t like listening to the podcast hosts and thinking “oh, no, I’m on the dim team”. So many smart words are said. Do not bury the smartness in “ek”, ek”, ek”.

Google:

What is etc short for?

“Etc.” is an abbreviation for the Latin phrase “et cetera.” In Latin, “et” means “and.” The word “cetera” means “the rest.” It’s pronounced, “et SET uh ruh.” The abbreviation “etc.” is used more frequently in writing than the full phrase.